Why Wait? Do It Yourself and Do It Right.

Fix Your Own Credit With The Most Advanced AI Dispute Engine Behind You

Our Trusted Partners

Your Goals. Your Plan. Your Credit.

DIYDisputes puts powerful AI tools at your fingertips so you can repair your credit without paying expensive service fees.

Spend Less Money

Our system is built by credit pros for real people with real goals who want to save on credit repair and keep more of their money for the goals they’re working toward.

Intelligent Credit Report Analysis

Automatically identify potential errors and items worth disputing, with clear explanations so you always know why something matters.

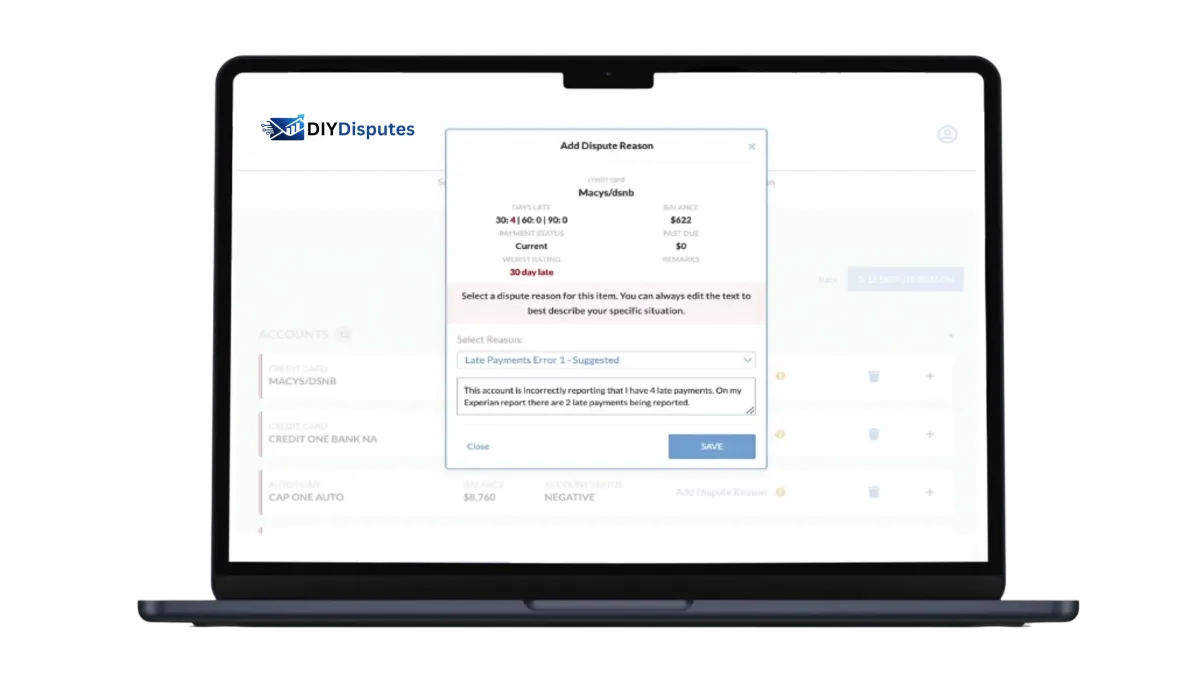

One-Click Dispute Letter Generator

Create unlimited customized letters tailored to each item, each bureau, and each dispute reason.

Your AI-Powered Credit Repair Pro At Your Fingertips

DIYDisputes uses advanced AI to simplify every step of the credit repair process, giving you expert insights without the expert price tag.

No more confusion. No more costly middlemen. Just clear guidance and powerful tools that help you protect your wallet and build your future.

Focus on Your Goals One Action At A Time

With a clean, easy-to-use interface, DIYDisputes AI helps you take action and move toward your financial goals faster.

AI-Powered Dispute Engine

Our advanced AI analyzes your reports, recommends dispute strategies, and drafts precise letters tailored to each bureau.

Smart Progress Tracking

Follow every dispute, deadline, and update in one place. No more spreadsheets, no confusion, no forgotten follow-ups.

Affordable & Transparent

Why pay hundreds or thousands to a credit repair company? DIYDisputes gives you the same (or better) tools at a fraction of the cost.

Spend Less. Fix More. Build Faster.

DIYDisputes helps you:

Save money by doing your own credit disputes with the help of industry-leading AI

Understand your credit with clarity, confidence, and simple explanations

Improve your financial opportunities by clearing errors that may be hurting your score

Big dreams don’t need big fees. They need the right tools — and that’s exactly what DIYDisputes delivers.

You Are Worthy Of Good Credit!

Maximizing your credibility with banks and lenders has never been easier. Take the right steps to improve your credit and start building a stronger financial future today.

Set Up Your Profile

Quickly set up your account in just a few simple steps.

Verify Your Information

Confirm your identity and pull your 3 Bureau Report.

Start Taking Action

Let the AI begin to generate disputes to challenge the negative information impacting your credit scores.

See What Our Customers Have to Say

“DIYDisputes really puts things in perspective and lays out a clear plan to improve our credit scores!”

My wife and I were skeptical at first and truly in fear of checking our credit score but DIYDisputes really put things in perspective and laid out a clear plan to improve our credit scores. We are excited!

P. Torres

Client

Take Action On Your Credit Goals

at an affordable cost

Premium DIY PLAN

Normally: $49.99/month

Unlimited AI Generated Disputes

Instant Credit Report Analysis

Monthly 3 Bureau Report & Scores

Monthly Progress Reports

Credit Building Tutorials & Resources

$1Million Identity Theft Fraud Insurance Policy

Request personal information removal from websites and data brokers

No contracts - cancel anytime

Frequently Asked Questions

Dive Into Our FAQs and Find Your Answers!

What is DIYDisputes?

DIYDisputes is an AI-powered credit repair tool that helps you dispute errors on your credit reports yourself — quickly, confidently, and affordably. Our advanced AI analyzes your reports, identifies issues, and generates custom dispute letters for you to send. It’s like having a credit repair expert in your pocket.

How does the AI help improve my credit?

Our advanced AI scans your credit report for inaccuracies, outdated information, and other items that may be lowering your score. It then writes personalized dispute letters for each issue — saving you time and guesswork while making the process more effective.

Do I have to send the dispute letters myself?

Yes. DIYDisputes generates your dispute letters, and you print, sign, and mail them. Letters coming from you (not a third-party company) are taken seriously by credit bureaus under the Fair Credit Reporting Act.

What if an item doesn’t get removed after one dispute?

It’s common for some accounts to require multiple rounds of dispute letters before they’re corrected or removed. Our AI and tools guide you step-by-step through follow-up letters until the process is complete.

Why do my credit scores vary between reports?

Credit scores change based on when and how a report is pulled, the scoring model used (FICO vs. VantageScore), and updates from lenders. Small fluctuations are normal and don’t necessarily reflect negative reporting.

How long should I wait for dispute results?

Credit bureaus generally have up to 30 days to investigate disputes once they receive your letters. Results can arrive sooner, but it’s best to allow the full timeframe before checking for report updates.

What types of accounts can I dispute?

You can dispute a wide range of items — including late payments, collections, inquiries, charge-offs, bankruptcies, and more — whenever you believe they’re inaccurate or can’t be verified.

How long will it take to fix my own credit?

The speed will be determined by the make up of your credit profile. Everyone's timeline is different as it depends on the dynamics of your credit profile. It can take a few months to start seeing improvements, but significant changes may take several months.